autocartlt.ru Community

Community

How To Move Out Of Florida

Checklist for future Florida residents. · Start Planning Your Move to Florida · Arrange for Your New Utilities · Enroll the Kids in a Florida School · Register to. If you are relocating outside the state of Florida we recommend not canceling your Florida insurance until you have registered your vehicle(s) in the state you. This group is made for people to share their stories why they moving out of Florida. lost of job, cant find a job,tired of the humidity, etc. Under Florida law, a parent who wants to relocate with his/her child has to follow specific steps. “Relocation” means a change in location of your primary. Try to find a job that will pay relocation fees. Out of state moves are very expensive. Alternately, rent the house out, get rid of or sell. Under Florida law, a parent who wants to relocate with his/her child has to If one of the reasons is based upon a job offer which has been out into writing. Here,. I provide some additional precautions a tenant should take during the move-out process to further reduce the chances of entering into a legal dispute. In Florida, the parental relocation law is clear: A judge will only grant a parent's request to relocate with a child if it is deemed in the child's best. In this article, we'll delve into three primary reasons why people are opting to leave Florida, including escaping high costs, grappling with insurance. Checklist for future Florida residents. · Start Planning Your Move to Florida · Arrange for Your New Utilities · Enroll the Kids in a Florida School · Register to. If you are relocating outside the state of Florida we recommend not canceling your Florida insurance until you have registered your vehicle(s) in the state you. This group is made for people to share their stories why they moving out of Florida. lost of job, cant find a job,tired of the humidity, etc. Under Florida law, a parent who wants to relocate with his/her child has to follow specific steps. “Relocation” means a change in location of your primary. Try to find a job that will pay relocation fees. Out of state moves are very expensive. Alternately, rent the house out, get rid of or sell. Under Florida law, a parent who wants to relocate with his/her child has to If one of the reasons is based upon a job offer which has been out into writing. Here,. I provide some additional precautions a tenant should take during the move-out process to further reduce the chances of entering into a legal dispute. In Florida, the parental relocation law is clear: A judge will only grant a parent's request to relocate with a child if it is deemed in the child's best. In this article, we'll delve into three primary reasons why people are opting to leave Florida, including escaping high costs, grappling with insurance.

We provide comprehensive apartment moving services for Florida residents. From packing and storage to our white glove moving service, we cover it all. Whether you are looking to buy a home or just renting, this checklist will help you organize your to-do list before and after you move to Florida. While Florida residency is required to purchase a Florida Prepaid Plan, it is not required to keep one. If you or the student move out of state, your plan will. A legal relocation in Florida is defined as a move of at least 50 miles for at least 60 days in a row, unless the time away is for vacation, health care or. Of course, all the time. Every single state has people moving in and out every year. For Florida in , the state had a moving into rate. This group is made for people to share their stories why they moving out of Florida. lost of job, cant find a job,tired of the humidity, etc. There is no abandonment in Florida. So if a party is concerned about leaving the house because they are somehow concerned they will lose money or. We must have a 30 day written notice in order to process your move out. Move out notices must be given at the 1st of the month and must be for the last day. There is no abandonment in Florida. So if a party is concerned about leaving the house because they are somehow concerned they will lose money or. Students not staying with us for the Fall semester are expected to move out 24 hours after their last final exam, but no later than noon, on Saturday, July Florida and St. Pete are full of active living retirement communities where getting to know the other people in the community is a given, through meals and. In this article, we will explore different strategies to help you move affordably without sacrificing quality or convenience. Moving out of Florida with your child without the other parent's approval is a complicated process. As a parent, you may have good reasons for wanting to. move before the term is up. In Florida, your landlord does not have to let you out of your lease if your employer transfers you, if you lose your job, or if. This process includes everything from sorting out legal paperwork to getting used to the way of life in Florida, which can be quite different from what you're. In this guide, we'll break down the essentials of moving to Florida, from understanding the state's unique climate to identifying its most vibrant communities. Under Florida law, a parent who wants to relocate with his/her child has to follow specific steps. “Relocation” means a change in location of your primary. Troy Fain Insurance has been helping Florida residents become and renew their notary public commissions since We also provide notary stamps. Upon moving out at the end of your lease, it shall be tenant responsibility to: 1. Clean the interior and exterior of the house including all appliances and. Florida law is strict about moving children during or after a divorce. Florida law must be followed when relocating or moving children with divorced parents.

Blank Check Acquisition Company

Special purpose acquisition companies, or SPACs, are a way some companies choose to go public A SPAC—which can also be known as a "blank check company"—is a. A SPAC is created specifically to pool funds in order to finance a merger or acquisition opportunity within a set timeframe. A special-purpose acquisition company also known as a "blank check company", is a shell corporation listed on a stock exchange with the purpose of acquiring. A type of blank check company is a “special purpose acquisition company,” or SPAC for short. A SPAC is created specifically to pool funds in. A SPAC is a blank-check company with no commercial operations. Its sole purpose is to raise capital through an initial public offering (IPO). Demystifying SPACs (Special Purpose Acquisition Companies). Understand how they work, the risks & rewards for investors, and the future of. A SPAC is a publicly traded corporation with a two-year life span formed with the sole purpose of effecting a merger, or “combination,” with a privately held. A SPAC, or special purpose acquisition company, is a business that raises money in the public market to acquire a private company. Because the money is. Publicly Traded Blank Check Companies - SIC Code Member Companies. This list is made from self-reported SIC codes that companies file with the SEC. Special purpose acquisition companies, or SPACs, are a way some companies choose to go public A SPAC—which can also be known as a "blank check company"—is a. A SPAC is created specifically to pool funds in order to finance a merger or acquisition opportunity within a set timeframe. A special-purpose acquisition company also known as a "blank check company", is a shell corporation listed on a stock exchange with the purpose of acquiring. A type of blank check company is a “special purpose acquisition company,” or SPAC for short. A SPAC is created specifically to pool funds in. A SPAC is a blank-check company with no commercial operations. Its sole purpose is to raise capital through an initial public offering (IPO). Demystifying SPACs (Special Purpose Acquisition Companies). Understand how they work, the risks & rewards for investors, and the future of. A SPAC is a publicly traded corporation with a two-year life span formed with the sole purpose of effecting a merger, or “combination,” with a privately held. A SPAC, or special purpose acquisition company, is a business that raises money in the public market to acquire a private company. Because the money is. Publicly Traded Blank Check Companies - SIC Code Member Companies. This list is made from self-reported SIC codes that companies file with the SEC.

Special Purpose Acquisition Companies (SPACs), also known as “blank check” companies, raise capital in an initial public offering for the purpose of. 7. Forum Merger II Corporation, $,,, Blank Check Company, North America. 8. Property Solutions Acquisition Corp. $,,, Blank Check Company. Special purpose acquisition companies, or SPACs, are a way some companies choose to go public A SPAC—which can also be known as a "blank check company"—is a. A special purpose acquisition company (SPAC) is a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition. A SPAC, sometimes referred to colloquially as a “blank check company,” is a shell company set up by investors with the intent of raising money through an. SPAC” stands for special purpose acquisition company, and it is a type of blank check company. A Special Purpose Acquisition Company, also known as a blank check company, is a company formed strictly to raise capital through an initial public offering . A special purpose acquisition company (SPAC) is a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition. Your SPAC is ready to acquire a company and infuse capital for rapid growth. SPAC (“blank check companies”) acquisitions require deep insights into rapid. A special purpose acquisition company (aka blank check company, shell company) is an investment company created for the sole purpose of acquiring an interest. Called “blank check companies,” SPACs provide IPO investors with little information prior to investing. SPACs seek underwriters and institutional investors. Why the buzz around special purpose acquisition companies (SPACs)? Here's everything you need to know about these "blank-check" firms. 7. Forum Merger II Corporation, $,,, Blank Check Company, North America. 8. Property Solutions Acquisition Corp. $,,, Blank Check Company. merger with a blank-check firm. autocartlt.ru August 23 Hong Kong eases listing thresholds for tech firms, SPAC deals in fresh tonic for IPO market. SDCL EDGE Acquisition Corporation (“SDCL EDGE”) is a newly formed blank check company (SPAC) that was incorporated on the 16th of February SPAC is an acronym for Special Purpose Acquisition Company, which is also known as a “blank check” company. A SPAC is a shell company which intends find a. List of Shell Companies or Special Purpose Acquisition Companies ('SPACs'). There are currently U.S. shell companies in our database. These. A SPAC is a blank-check company with no commercial operations. Its sole purpose is to raise capital through an initial public offering (IPO). SPAC” stands for special purpose acquisition company, and it is a type of blank check company. Blank Check Company. Also known as a Special Purpose Acquisition Company, or SPAC, this is a shell corporation that raises cash through an IPO.

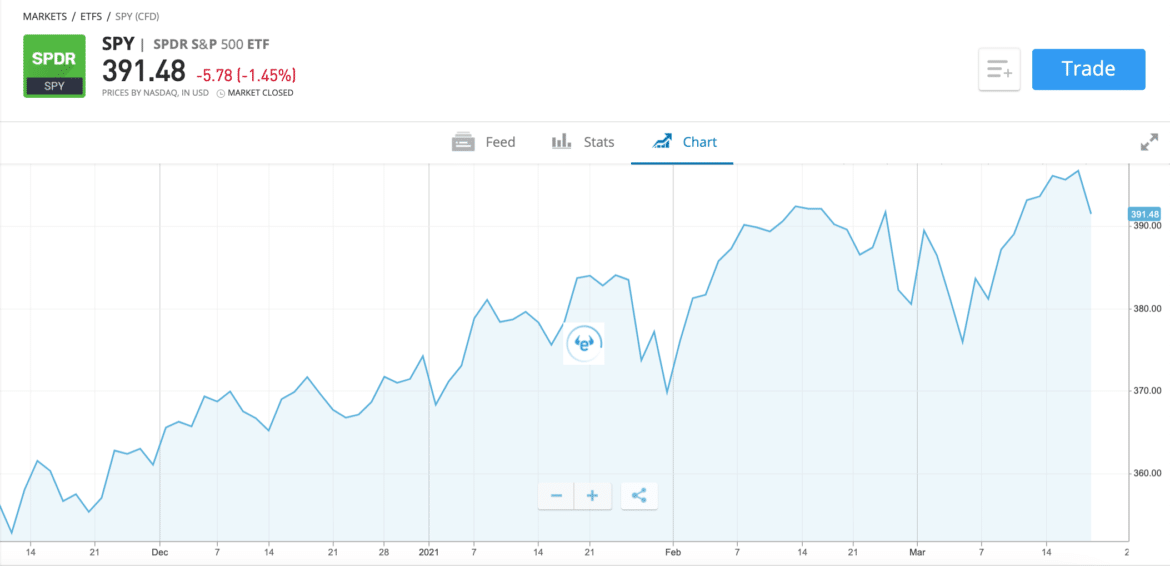

What Is The Etf For S&P 500

S&P Index (INDEXSP INX) – ETF Tracker The index measures the performance of the large capitalization sector of the U.S. equity market and is considered. ProShares S&P Ex-Technology focuses on S&P ® companies, excluding those in the information technology sector. Best S&P index funds · Fidelity ZERO Large Cap Index (FNILX) · Vanguard S&P ETF (VOO) · SPDR S&P ETF Trust (SPY) · iShares Core S&P ETF (IVV). The investment seeks to track the total return of the S&P ® Index. The fund generally invests at least 80% of its net assets (including, for this purpose. The Calamos Structured Protected ETFs are designed to match the positive price return of the S&P up to a defined cap while protecting against % of. ProShares Ultra S&P seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily performance of the S&P ®. The SPDR® S&P ® ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P. Top 25 ETFs ; 2, IVV · iShares Core S&P ETF ; 3, VOO · Vanguard S&P ETF ; 4, VTI · Vanguard Total Stock Market ETF ; 5, QQQ · Invesco QQQ Trust Series I. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. S&P Index (INDEXSP INX) – ETF Tracker The index measures the performance of the large capitalization sector of the U.S. equity market and is considered. ProShares S&P Ex-Technology focuses on S&P ® companies, excluding those in the information technology sector. Best S&P index funds · Fidelity ZERO Large Cap Index (FNILX) · Vanguard S&P ETF (VOO) · SPDR S&P ETF Trust (SPY) · iShares Core S&P ETF (IVV). The investment seeks to track the total return of the S&P ® Index. The fund generally invests at least 80% of its net assets (including, for this purpose. The Calamos Structured Protected ETFs are designed to match the positive price return of the S&P up to a defined cap while protecting against % of. ProShares Ultra S&P seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily performance of the S&P ®. The SPDR® S&P ® ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P. Top 25 ETFs ; 2, IVV · iShares Core S&P ETF ; 3, VOO · Vanguard S&P ETF ; 4, VTI · Vanguard Total Stock Market ETF ; 5, QQQ · Invesco QQQ Trust Series I. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities.

Learn everything you need to know about SPDR® S&P ® ETF Trust (SPY) and how it ranks compared to other funds. Research performance, expense ratio. S&P index funds are among the most popular investment choices in the U.S. thanks to their low costs, minimal turnover rate, simplicity and performance. S&P sector exchange-traded funds (ETFs) provide exposure to individual sectors within the S&P index, such as technology, healthcare, or energy. They are baskets of stocks and bonds, many of which are built to track well-known market indexes like the S&P ®. Diversification. ETFs are collections of. The best S&P ETFs by cost and performance: ✓ Ongoing charges as low as % p.a. ✓ 24 ETFs track the S&P The Direxion Daily S&P ® Bull 2X Shares seeks daily investment results of the performance of the S&P ® Index. Largest ETFs: Top ETFs By Assets ; IVV · iShares Core S&P ETF, $,, ; VOO · Vanguard S&P ETF, $,, ; VTI · Vanguard Total Stock. An index fund or exchange-traded fund (ETF) that benchmarks to the S&P allows investors to gain exposure to all those stocks. ETFs focus on passive index. ETF Select List ; Large Value, SCHV, Schwab US Large-Cap Value ETF™ DJ US TSM Large Cap Value TR USD ; Large Value, SPYV, SPDR® Portfolio S&P Value ETF S&P. Find the latest Vanguard S&P ETF (VOO) stock quote, history, news and other vital information to help you with your stock trading and investing. Vanguard S&P ETF is an exchange-traded share class of Vanguard Index Fund. Using full replication, the portfolio holds all stocks in. The Fund and the Index are rebalanced quarterly. ETF information. Fund name. Invesco S&P Equal Weight ETF. Fund ticker. RSP. CUSIP. V The iShares S&P Index ETF seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the S&P Index. The Invesco S&P ® Momentum ETF (Fund) is based on the S&P Momentum Index (Index). The Fund generally will invest at least 90% of its total assets in the. The iShares S&P Growth ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities that exhibit growth. Find the latest SPDR S&P ETF Trust (SPY) stock quote, history, news and other vital information to help you with your stock trading and investing. Let's say you wanted to own all stocks in the S&P Index. Instead, you could gain this broad exposure through an ETF that tracks the S&P Index. Consider this low-cost exchange-traded fund to round out your U.S. equity exposure. Vanguard Extended Market ETF (VXF) invests in nearly all U.S. stocks. As mentioned earlier, the SPY ETF aims to track the performance of the S&P index which comprises of large cap stocks in the US. The list is subject to. Unique Exchange Traded Funds (ETFs) that divide the S&P into eleven sector index funds. Customize the S&P to meet your investment objective.

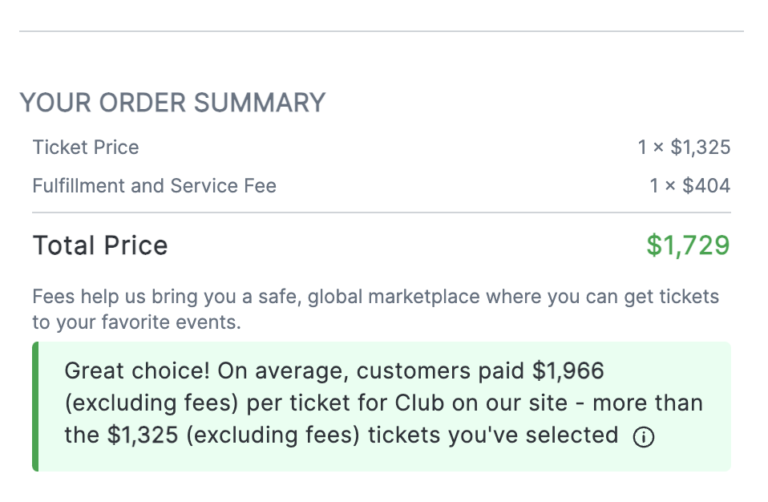

How To Not Pay Service Fee Stubhub

Fees are standard, but not flat for StubHub. As a buyer, you will pay 10% extra for all the processing and organization. It is a service fee. As a seller. didn't have this service. Thanks for I will be more comfortable paying full price through a first-party vendor going forward without the headaches. StubHub charges a fee when fans buy and sell tickets on our site · There is no set percentage for fees, and fees can change based on ticket price, time to event. So, even though you transferred tickets through Ticketmaster, no actual funds were transferred — thus, no Do you have to pay taxes on StubHub fees? No. I called Stub Hub back and they told me if I did not pay the $ and As a matter of policy, BBB does not endorse any product, service or business. So, even though you transferred tickets through Ticketmaster, no actual funds were transferred — thus, no Do you have to pay taxes on StubHub fees? No. 19M posts. Discover videos related to How to Get Rid of Service Fees on Stubhub on TikTok. See more videos about How to Get Paid on Stubhub, How to Get. StubHub ranked #1 in Newsweek's America's Best Customer Service TickPick: No Fee Tickets. Entertainment. On the StubHub app: Select Filters." Under "Price Display Options," select the "Include estimated fees" toggle. Then select "View Listings." · On a computer. Fees are standard, but not flat for StubHub. As a buyer, you will pay 10% extra for all the processing and organization. It is a service fee. As a seller. didn't have this service. Thanks for I will be more comfortable paying full price through a first-party vendor going forward without the headaches. StubHub charges a fee when fans buy and sell tickets on our site · There is no set percentage for fees, and fees can change based on ticket price, time to event. So, even though you transferred tickets through Ticketmaster, no actual funds were transferred — thus, no Do you have to pay taxes on StubHub fees? No. I called Stub Hub back and they told me if I did not pay the $ and As a matter of policy, BBB does not endorse any product, service or business. So, even though you transferred tickets through Ticketmaster, no actual funds were transferred — thus, no Do you have to pay taxes on StubHub fees? No. 19M posts. Discover videos related to How to Get Rid of Service Fees on Stubhub on TikTok. See more videos about How to Get Paid on Stubhub, How to Get. StubHub ranked #1 in Newsweek's America's Best Customer Service TickPick: No Fee Tickets. Entertainment. On the StubHub app: Select Filters." Under "Price Display Options," select the "Include estimated fees" toggle. Then select "View Listings." · On a computer.

If you no longer want the tickets you purchased, you can easily resell them on StubHub – even if you haven't received the tickets yet. There are no fees to. Control over Price: StubHub lets you set your own ticket price. This means you can adjust it based on what similar tickets are going for and potentially snag a. For Stubhub, it is free to list tickets for sale. On each completed transaction, the buyer pays a 10% fee, and sellers are charged a 15% fee. Similar to many of its competitors in the online ticket industry, StubHub does not disclose its service fees when a ticket price is first. Once you join, you'll never want to use StubHub again. Because you'll never pay a service fee again. Join today. Use Code: NOSTUBHUB. Get My Free Membership. If your event is canceled and not rescheduled, you will receive a credit worth % of the amount you paid for the impacted event or the option of a cash refund. The add-on fees would be around 22% of the original ticket price. This is in line with, but a bit higher than Ticketmaster. With StubHub, the bulk of their fees. Both StubHub and TicketMaster charge fees for their services. StubHub charges 10% for buyers and 15% for sellers. Listing and searching for tickets are free of. Creating and publishing your ticket listings on StubHub is completely free! You incur no costs for listing your tickets. However, once your tickets are sold. Additionally, Porras alleges, "[StubHub] misleads consumers to believe that payment of the Service Fee assures that tickets sold through its website will be. It's free to list tickets on StubHub! When they sell, we collect a sell fee. This may change over time depending on ticket supply and ticket marketing costs. If you purchased tickets through StubHub and were shown some, but not all of the fees until the end of the purchasing process, you may be able to have the. Anyone who has a ticket can re-sell through Stub Hub at whatever price they wish, and Stub Hub charges a fee for the service. tickets, there are no additional. In cases where a seller is unable to fulfill an order after their tickets are sold, StubHub may charge a sellers payment method an amount equal to % of the. A: StubHub only charges sellers when tickets are sold. It is FREE to list your tickets. Fees vary depending on the event, price, and delivery method. The fees. StubHub did not pay ticketholders for any tickets on its own behalf or to StubHub did not charge the ticketholder any fees. StubHub charged the buyer's. This profile is not for international StubHub domains, which is operated by StubHub International (a different company). Categories. Event Ticket Seller. The ServiceHub is your go-to service centre for the Office of the Registrar. We offer support for: Undergraduate admissions; Fees and financial assistance. Control over Price: StubHub lets you set your own ticket price. This means you can adjust it based on what similar tickets are going for and potentially snag a. When you sell tickets on StubHub, we don't charge extra fees for being paid through PayPal. If you ask PayPal to send you a check, there may be an extra.

Getting A Credit Card After Chapter 13

Even for those who are not able to get any regular credit card after bankruptcy, there is an alternative—a secured credit card. This type of card requires a. Consider applying for a secured credit card when you have some cash on hand to submit as a security deposit (many secured cards require at least a $ deposit. You'll need court authorization. Most courts require that you get prior authorization for new credit. Some districts provide general guidelines for new credit. So, while not the norm, it is sometimes possible to continue use of a credit card while in a Chapter 13 case, but most likely it will be restricted to business. With Chapter 13, you can pay down your debt regularly based on your regular income. You can propose this plan in bankruptcy court where it's decided by a judge. Fortunately, this is far from the truth, as obtaining credit cards after bankruptcy is not difficult. In the event that you have questions or concerns regarding. HOW LONG DOES IT TAKE TO GET A NEW CREDIT CARD AFTER BANKRUPTCY? My clients usually receive offers for new credit cards in the mail within a month of filing for. In Chapter 13, you'll likely pay off some portion of your credit card balance. But it might not be much. The amount will depend on whether you have income. You can't apply for any new form of credit until your bankruptcy has been discharged. A discharge occurs when you have officially been released of your. Even for those who are not able to get any regular credit card after bankruptcy, there is an alternative—a secured credit card. This type of card requires a. Consider applying for a secured credit card when you have some cash on hand to submit as a security deposit (many secured cards require at least a $ deposit. You'll need court authorization. Most courts require that you get prior authorization for new credit. Some districts provide general guidelines for new credit. So, while not the norm, it is sometimes possible to continue use of a credit card while in a Chapter 13 case, but most likely it will be restricted to business. With Chapter 13, you can pay down your debt regularly based on your regular income. You can propose this plan in bankruptcy court where it's decided by a judge. Fortunately, this is far from the truth, as obtaining credit cards after bankruptcy is not difficult. In the event that you have questions or concerns regarding. HOW LONG DOES IT TAKE TO GET A NEW CREDIT CARD AFTER BANKRUPTCY? My clients usually receive offers for new credit cards in the mail within a month of filing for. In Chapter 13, you'll likely pay off some portion of your credit card balance. But it might not be much. The amount will depend on whether you have income. You can't apply for any new form of credit until your bankruptcy has been discharged. A discharge occurs when you have officially been released of your.

Many people can repair credit quickly after bankruptcy and are offered credit lines soon after receiving a bankruptcy discharge. You can also explore other ways. For debtors filing bankruptcy, the best solution is probably to keep all of your credit card debt in bankruptcy and get a secured credit card after your. When you're in Chapter 13 bankruptcy, it's hard to get new credit cards or loans. But the court might let you get new credit if you can prove you really need it. Generally depends on the lender and whether or not they were included in the bankruptcy can matter as well. For example, Capital One is known to. If you file for a Chapter 7 bankruptcy, you can apply for credit as soon as the debt is discharged. With Chapter 13 bankruptcy, you will need to receive prior. After completing your bankruptcy, you can get another credit card. In the long run, you may be able to improve your credit by making timely payments on your. In Chapter 13, you are not permitted to borrow or use any other form of credit unless you have written permission from the Bankruptcy Judge or the Chapter So, you may see a dramatic drop in your score in the first month immediately following your bankruptcy filing, but by the end of the first year it could have. If you used your credit card to pay for these, those charges may not be discharged through Chapter 7 bankruptcy. Chapter 13 Bankruptcy and Credit Card Debt. The first reason you cannot keep a credit card is because you are not allowed to show preference to specific unsecured creditors while in bankruptcy. Can you get a credit card after bankruptcy? You can, however, always get new credit cards after filing for bankruptcy. Many of my clients continue to get. Chapter 7 and Chapter 13 are the two main bankruptcy chapters that can discharge credit card debt. · Sometimes, credit card debt can not be discharged due to. For debtors filing bankruptcy, the best solution is probably to keep all of your credit card debt in bankruptcy and get a secured credit card after your. Chapter 7 and Chapter 13 are the two main bankruptcy chapters that can discharge credit card debt. · Sometimes, credit card debt can not be discharged due to. After your case is done, you can begin rebuilding your credit. In just a few short months, you may start applying for credit cards. Chapter 13 takes more time. Discharging Credit Card Debt Should you successfully complete your Chapter 13 repayment plan after the three- to five-year period, the bankruptcy court then. Rising credit card debt is a leading reason why Americans get into a How You Can Keep Your House Through Chapter 7 or Chapter 13 Bankruptcy. The. Monitor credit report for accuracy · Make on-time payments on debts not included in your bankruptcy · Build credit with a secured or retail credit card · Have. Highlights: · Become an authorized user on someone else's credit card account. · Have someone cosign a loan or new credit card. · Apply for a gas station or local. While credit card debt may be discharged through a bankruptcy, a creditor might object to the discharge of particular charges right before declaring bankruptcy.

T Rowe Price Retirement Income 2020

The Fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. The fund in question is the T. Rowe Price Retirement Income Fund, classified under the Equity asset class. It has an annual capital gain distribution. T. Rowe Price Retirement Income Inv TRLAX · NAV / 1-Day Return / − % · Total Assets Mil · Adj. Expense Ratio. % · Expense Ratio %. T. ROWE PRICE RETIREMENT TRUST (CLASS INCOME F)- Performance charts including intraday, historical charts and prices and keydata. The fund's managed payout strategy is designed to provide a stream of predictable monthly distributions throughout retirement, targeting 5% annually. T. Rowe Price Retirement Income I overview and insights. Find the latest T. Rowe Price Retirement Income Inv (TRLAX) stock quote, history, news and other vital information to help you with your stock trading. Objective. The investment seeks to provide monthly income. The fund pursues its objective by investing in a diversified portfolio of other T. Rowe Price stock. The fund is managed based on the specific retirement year (target date ) included in its name and assumes a retirement age of The Fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. The fund in question is the T. Rowe Price Retirement Income Fund, classified under the Equity asset class. It has an annual capital gain distribution. T. Rowe Price Retirement Income Inv TRLAX · NAV / 1-Day Return / − % · Total Assets Mil · Adj. Expense Ratio. % · Expense Ratio %. T. ROWE PRICE RETIREMENT TRUST (CLASS INCOME F)- Performance charts including intraday, historical charts and prices and keydata. The fund's managed payout strategy is designed to provide a stream of predictable monthly distributions throughout retirement, targeting 5% annually. T. Rowe Price Retirement Income I overview and insights. Find the latest T. Rowe Price Retirement Income Inv (TRLAX) stock quote, history, news and other vital information to help you with your stock trading. Objective. The investment seeks to provide monthly income. The fund pursues its objective by investing in a diversified portfolio of other T. Rowe Price stock. The fund is managed based on the specific retirement year (target date ) included in its name and assumes a retirement age of

The fund invests in a diversified portfolio of other T. Rowe Price stock and bond funds that represent various asset classes and sectors. Glidepath Strategy. Target-date funds employ glidepaths, which are the planned progression of asset allocation changes (e.g., mix of equity and fixed-income. TRLAX: T. Rowe Price Retirement Income Fund - Fund Profile. Get the lastest Fund Profile for T. Rowe Price Retirement Income Fund from Zacks. The investment seeks the highest total return over time consistent with an emphasis on both capital growth and income. The fund invests in a diversified. T Rowe Price Retirement Income Fund ; Yield % ; Net Expense Ratio % ; Turnover % 35% ; 52 Week Avg Return % ; Portfolio Style, Income. The fund is a target date fund that includes a managed payout program to provide shareholders with a regular level of monthly income each calendar year. when considering when to retire, what their retirement needs will be, and what sources of income Interest rates: The prices of bonds and other fixed income. T. Rowe Price Retirement Fund TRRBX ; NAV, Change, Net Expense Ratio, YTD Return. YTD Return is adjusted for possible sales charges, and assumes. TRLAX T. Rowe Price Retirement Income Fund Other. ETF Price & Overview ; Consumer Defensive. % ; Real Estate. % ; Utilities. % ; Securitized. %. The T. Rowe Price Retirement Income Fund (TRLAX) is a mutual fund designed for investors who are approaching or in retirement. We're driven by our purpose: To identify and actively invest in opportunities to help people thrive in an evolving world. T. Rowe Price Funds, Ticker Symbol, Long-Term Gain Per Share ; Retirement Income · TRLAX, $*. investment or investment management decision. Income for Retirement Income Fund is not guaranteed and is subject to change. Let's. View the latest T Rowe Price Retirement Income Fund (TRLAX) stock price, news, historical charts, analyst ratings and financial information from WSJ. Each index provides varying levels of exposure to equities and fixed income. Each target date allocation is created and retired according to a pre-determined. Like other target-date funds the T. Rowe Price Retirement Fund starts off aggressive and gradually changes to accommodate a conservative portfolio as. T. Rowe Price Retirement Income InvTRLAX ; YTD. % ; 1 Year. % ; 3 Year. % ; 5 Year. % ; 10 Year/Life. %. T. Rowe Price Retirement Fund. %, % ; Target-Date Close. %, % ; AFTER TAXES ON DISTRIBUTIONS AND SALE OF FUND SHARES. Close ; T. Rowe. The fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. The investment seeks to provide monthly income. The fund pursues its objective by investing in a diversified portfolio of other T. Rowe Price stock and bond.

Using The Accrual Method

Using the accrual method, you record revenue when the sale occurs, and you record expenses when you receive the goods or services — regardless of when. Under the accrual basis of accounting (or accrual method of accounting), revenues are reported on the income statement when they are earned. Unlike the cash method of accounting, which reports income when it's received, the accrual method reports income when it's earned, regardless of when payment. that accounts for short-term assets using the cash method and long-term assets using the accrual method. The accrual method is the only method of accounting. In accrual accounting, you record revenue when it's earned and expenses when they are incurred, not when cash changes hands. Your accounting, and the financial. Taxpayers using the accrual method of accounting include amounts in income when: Accrual-method taxpayers take deductions or credits in the year in which. Using the accrual method gives you a good idea of the cash inflows and outflows you can expect for a given period and plans your cash management accordingly. Accrual cash accounting · Using the cash method, revenue is recorded when money comes in and expenses are recorded when they are paid. This is often considered. The most commonly used accounting methods are the cash method and the accrual method. Under the cash method, you generally report income in the tax year you. Using the accrual method, you record revenue when the sale occurs, and you record expenses when you receive the goods or services — regardless of when. Under the accrual basis of accounting (or accrual method of accounting), revenues are reported on the income statement when they are earned. Unlike the cash method of accounting, which reports income when it's received, the accrual method reports income when it's earned, regardless of when payment. that accounts for short-term assets using the cash method and long-term assets using the accrual method. The accrual method is the only method of accounting. In accrual accounting, you record revenue when it's earned and expenses when they are incurred, not when cash changes hands. Your accounting, and the financial. Taxpayers using the accrual method of accounting include amounts in income when: Accrual-method taxpayers take deductions or credits in the year in which. Using the accrual method gives you a good idea of the cash inflows and outflows you can expect for a given period and plans your cash management accordingly. Accrual cash accounting · Using the cash method, revenue is recorded when money comes in and expenses are recorded when they are paid. This is often considered. The most commonly used accounting methods are the cash method and the accrual method. Under the cash method, you generally report income in the tax year you.

Basically, when using cash accounting method, you wouldn't recognize accounts receivable or accounts payable. Accrual accounting recognizes both of these. On a. Benefits of Using the Accrual Method · Accurate Financial Representation · Improved Financial Planning and Analysis · Enhanced Regulatory Compliance and Reporting. Under the accrual basis method of accounting, transactions are accounted for when the transaction occurs or is earned, regardless of when the cash is paid or. It uses the matching principle to record transactions when they occur, regardless of whether or not you've exchanged cash payments. While this method may be a. Under the accrual method, you generally report income in the tax year you earn it, regardless of when payment is received. You deduct expenses in the tax year. Accruals (and deferrals) are made via journal entries at the end of each accounting period using an Accrual Voucher in the Kuali Financial System. These are. Hybrid Accounting · If you report income using the cash method, you must also report expenses using the cash method; · If you report income using the accrual. With the accrual method, income and expenses are recorded when they are obligated to be paid. In other words, if you make a sale, you record it as income on the. Under the accrual method income is reported in the year it is earned without regard to when the income is actually received. Expenses are reported in the year. Generally, a business that uses an accrual method of accounting will normally report income as it is earned (billed). Under this method of accounting, a. Accrual accounting is an excellent methodology for a company to manage debt, income, and financial activity. If you use accrual accounting, you record expenses and sales when they take place, instead of when cash changes hands. This way of accounting shows the amounts. Under the accrual method, you record business income when a sale occurs, whether it be the delivery of a product or the rendering of a service on your part. Using the accrual method, you would record the $6, for services rendered as revenue right away, regardless of when the client pays the bill. If your. You report business income by using the accrual method of accounting or the cash method and based on a fiscal period. It Simplifies Strategic Planning Since accrual accounting reflects certain future cash flow activities, it enables much better strategic planning. With this. With the accrual method, income and expenses are recorded when they are obligated to be paid. In other words, if you make a sale, you record it as income on the. ▻ The modified accrual method works well when inventory is accounted for using the accrual method, and the cash method is used for recording income and. Paying taxes on money not yet received. An advantage to using accrual accounting is that you can report income when the sale is incurred instead of waiting. For example, while businesses using cash accounting incur tax liability when funds from a sale hit their account, businesses using accrual accounting are taxed.

Multiple Retirement Accounts

Easier account management. If you've racked up several (k)s from jobs or have more than a couple IRAs, keeping track of them might be overwhelming. The rollover IRA can help you turn a hodge-podge of holdings into a single investment blueprint and unified asset allocation plan. Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP). While it is possible to have multiple Roth IRAs, there are still limits as to much how you can contribute on an annual basis. Many workers have both a (k) plan and an IRA at their disposal, so that gives them two tax-advantaged ways to save for retirement, and they should make the. Rollover IRAs: A way to combine old (k)s and other retirement accounts · Leave your money in your former employer's plan, if your former employer permits it. You can contribute to different types of IRAs. Contributing to a Roth IRA and a traditional IRA is absolutely allowed as long as you're eligible. No. Although you can have multiple IRAs, (k)s, and other retirement accounts, the limits on how much you can contribute during a tax year. You can contribute to different types of IRAs. Contributing to a Roth IRA and a traditional IRA is absolutely allowed as long as you're eligible. Easier account management. If you've racked up several (k)s from jobs or have more than a couple IRAs, keeping track of them might be overwhelming. The rollover IRA can help you turn a hodge-podge of holdings into a single investment blueprint and unified asset allocation plan. Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP). While it is possible to have multiple Roth IRAs, there are still limits as to much how you can contribute on an annual basis. Many workers have both a (k) plan and an IRA at their disposal, so that gives them two tax-advantaged ways to save for retirement, and they should make the. Rollover IRAs: A way to combine old (k)s and other retirement accounts · Leave your money in your former employer's plan, if your former employer permits it. You can contribute to different types of IRAs. Contributing to a Roth IRA and a traditional IRA is absolutely allowed as long as you're eligible. No. Although you can have multiple IRAs, (k)s, and other retirement accounts, the limits on how much you can contribute during a tax year. You can contribute to different types of IRAs. Contributing to a Roth IRA and a traditional IRA is absolutely allowed as long as you're eligible.

The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans. A rollover IRA offers a great way to consolidate multiple accounts into one IRA. Note that many types of retirement accounts, not just workplace plans, can be. Yes the retirement account contribution rules permit contributions to multiple k plans including a self-directed solo k plan. There's no such thing as a joint retirement account, but you can still save for the future together. There is no limit to the number of individual retirement accounts (IRAs) that you can establish. But you'll still be subject to your annual maximum. Employer plans, IRAs, and taxable accounts can all be used for retirement saving. Here are some options that may help you reach your retirement savings goals. There are two common types of IRAs: traditional and Roth; each has different eligibility requirements, contribution limits, and tax benefits. Read more. You can have multiple IRAs, as the IRS sets no cap on the number of IRAs you can own, but there is a limit on the amount of money you can contribute in total. There are two common types of IRAs — traditional and Roth. Traditional or Roth IRA? If you're looking for an opportunity to save for retirement in a tax-. Answer: So every time I or my wife change jobs we transfer our K balances into an IRA or ROTH IRA account depending on how the money was invested. I am 30 years old and have 2 retirement accounts (both k match) from previous employers and just started working for a new company. The maximum you may defer to your new employer's plan in is $17, (your $19, individual limit - $2, that you've already deferred to your former. Consolidating or rolling them over into one account is one way to alleviate that burden. 6 Benefits of Consolidating Retirement Accounts. There are several. If one of you has multiple IRAs or (k)s, then you're making your investment management harder than it needs to be. In addition, you may also be paying more. Rollover IRAs: A way to combine old (k)s and other retirement accounts · Leave your money in your former employer's plan, if your former employer permits it. The short answer is that there is no limit to the number of retirement accounts you can have. However, the IRS does have rules that govern how much you can. If one of you has multiple IRAs or (k)s, then you're making your investment management harder than it needs to be. In addition, you may also be paying more. The answer is yes, IRAs, (k)s, and other qualified retirement accounts are allowed to invest in MLPs the same as any other traded security. You can roll multiple k accounts into one IRA. This avoids taxable events and consolidates multiple retirement accounts into one, making it simpler to. Advantages of being in more than one plan. You can add up service credit earned in all dual member systems to become eligible to retire. You might be able to.

Financial Planners In Wichita Ks

Wichita has up to advisors to choose from and using our filters for fee structure, specialties and experience, you can find the best advisor for you. Wichita, KS Financial Advisor | Serving Area Codes and | Sedgwick, Reno, Butler Counties · About Us. The members of our firm have over 40 years of. WICHITA, KS · · North Rock Road Suite Wichita, KS · Hours of Operation: Mon - Fri: AM - PMSee More Hours · Learn more. Mike Crabtree is a financial advisor serving Wichita, KS. Start planning your financial future today. Brandon Giefer is a financial advisor serving Wichita, KS. Start planning your financial future today. About Our Branch. Our team of Financial Advisors can provide a full range of financial products and services, from helping you select individual investments to. StewardRight's team are independent, fee-based and full-fiduciary financial planners for individuals and businesses who want to do better than they are right. From tax planning to estate planning, your planner can also tap into our in-house experts for an extra layer of financial planning insight. Wichita Wealth: Wichita's original fee-only, fiduciary financial planning firm. Specializing in retired and aviation professionals. Wichita has up to advisors to choose from and using our filters for fee structure, specialties and experience, you can find the best advisor for you. Wichita, KS Financial Advisor | Serving Area Codes and | Sedgwick, Reno, Butler Counties · About Us. The members of our firm have over 40 years of. WICHITA, KS · · North Rock Road Suite Wichita, KS · Hours of Operation: Mon - Fri: AM - PMSee More Hours · Learn more. Mike Crabtree is a financial advisor serving Wichita, KS. Start planning your financial future today. Brandon Giefer is a financial advisor serving Wichita, KS. Start planning your financial future today. About Our Branch. Our team of Financial Advisors can provide a full range of financial products and services, from helping you select individual investments to. StewardRight's team are independent, fee-based and full-fiduciary financial planners for individuals and businesses who want to do better than they are right. From tax planning to estate planning, your planner can also tap into our in-house experts for an extra layer of financial planning insight. Wichita Wealth: Wichita's original fee-only, fiduciary financial planning firm. Specializing in retired and aviation professionals.

Morgan Stanley Wichita Branch Financial Advisors can help you achieve your financial goals. If you are interested in professional financial advising and wealth management guidance built around the totality of your financial situation and your personal. Baxter & Associates is a boutique financial planning firm serving clients since Using our holistic approach, we help clients set, reach and maintain. The financial advisors at Driven Wealth Strategies provide wealth management, financial planning and retirement planning services to Wichita, KS. Longview Advisors is a comprehensive, fee-only wealth management and financial planning firm with offices in Newton and Wichita, Kansas. Don Grant is a Certified Financial Planner™ professional in Wichita, Kansas. Don has a wealth of life experiences that give him the ability to help guide a. Adams Brown Wealth Consultants has years of experience assisting individuals in Wichita and across Kansas navigate the complex financial planning landscape. Our Wichita, KS advisors provide financial advisory services to individuals, retirement plan sponsors, and endowments and foundations. Very few people but the ultra wealthy needs someone taking a big cut of their money for financial planning. Wichita, KS. A subreddit for. financial planning in Kansas and the community for financial planners Location: Stoutheart Financial Group | E 21st St N Ste , Wichita, KS Wichita has up to advisors to choose from and using our filters for fee structure, specialties and experience, you can find the best advisor for you. Our wealth advisors in Wichita, Kansas, will work with you on creating a personalized financial plan designed to help you reach short-term goals. Your Financial Advisors in Wichita, KS - 4 First Command Advisors · Mike Crabtree. E Harry St. Suite Wichita, Kansas. () · Gavin Crowe. Travis Kvassay is an Ameriprise Financial Advisor serving the Wichita, KS area. Get the personal financial advice you need to achieve your goals. Find a financial advisor in the Wichita, KS area. Review the verified advisors below. Visit their websites. Contact them directly. Ask lots of questions. We're here to provide you with personalized financial planning based on your goals, your time frame and your particular tolerance for risk. Wichita, KS Visit us. () () Contact us. Learn Merrill offers a broad range of brokerage, investment advisory (including. Financial Advisors · Thomas M West. First Vice President, Financial Advisor, Alternative Investments Director · Jim Roman. Vice President, Wealth Management. Our CFS* financial advisors understand you have both short-term and long-term financial goals, and they are ready to help you achieve them all. Thomas Dean Mc Millen is an Ameriprise Financial Advisor serving the Wichita, KS area. Get the personal financial advice you need to achieve your goals.

Define Asset Manager

ASSET MANAGER definition: 1. a person or company that manages someone else's money, stocks, and shares, etc. 2. a person or. Learn more. Asset Management Defined. As a basic definition, asset management is just managing client's money with the goal of growing that money, so generating returns. Asset management involves the balancing of costs, opportunities and risks against the desired performance of assets to achieve an organisation's objectives. Asset managers provide their products and services primarily to institutional clients such as pension funds, insurance companies, sovereign wealth funds and. Asset management funds generally cater to a client base composed of large institutional investors and high-net-worth individuals. This client base includes. Our customizable asset manager job description template, optimized for search performance and conversion, will help you find the right fit. An asset manager is a professional who manages the assets of a client. Being an investment manager, the asset manager maintains a wide range of assets. Simply put, asset management firms manage funds for individuals and companies. They make well-timed investment decisions on behalf of their clients to grow. What does an asset manager do? · Maximising profitability · Running and analysing inventories of all assets · Liaising with suppliers to obtain the best price. ASSET MANAGER definition: 1. a person or company that manages someone else's money, stocks, and shares, etc. 2. a person or. Learn more. Asset Management Defined. As a basic definition, asset management is just managing client's money with the goal of growing that money, so generating returns. Asset management involves the balancing of costs, opportunities and risks against the desired performance of assets to achieve an organisation's objectives. Asset managers provide their products and services primarily to institutional clients such as pension funds, insurance companies, sovereign wealth funds and. Asset management funds generally cater to a client base composed of large institutional investors and high-net-worth individuals. This client base includes. Our customizable asset manager job description template, optimized for search performance and conversion, will help you find the right fit. An asset manager is a professional who manages the assets of a client. Being an investment manager, the asset manager maintains a wide range of assets. Simply put, asset management firms manage funds for individuals and companies. They make well-timed investment decisions on behalf of their clients to grow. What does an asset manager do? · Maximising profitability · Running and analysing inventories of all assets · Liaising with suppliers to obtain the best price.

In commercial real estate investment, an asset manager is a professional or firm that oversees the management and value of one or more investment assets. In commercial real estate investment, an asset manager is a professional or firm that oversees the management and value of one or more investment assets. Fixed asset management involves tracking, monitoring and maintaining equipment, computers, vehicles and other physical assets. Asset management is when investment professionals run your investment portfolio. This means that they research and analyze the markets to mitigate risk. The financial institutions managing the money are called asset managers, and they develop and execute investment strategies that create value for their clients. Private asset management is the engagement of a manager to oversee a financial portfolio. The portfolio may belong to an individual or family investor and will. An asset manager is hired to manage, track, and monitor a company's asset portfolio to improve decision-making when managing high-value assets. Asset managers aim to grow their clients' assets by investing the money into fixed-income, equity, or alternative investments while taking on risks appropriate. We define asset managers as institutions that take a fee for managing money via investing it for a beneficiary. Real estate asset management is the act of operating, maintaining, and improving properties to achieve specific financial goals for the owner(s) or investors. “Asset management” refers to the financial service of managing assets with the aim of increasing the value of the invested financial instruments. An asset management company (AMC) invests pooled funds from clients into a variety of securities and assets. Asset Management is the process responsible for tracking and reporting the value and ownership of financial assets throughout their lifecycle. ASSET MANAGEMENT meaning: 1. the management of someone's money, stocks, shares, etc.: 2. the management of someone's money. Learn more. Under its licence as an AIFM, the Manager is authorized to provide the investment services of (i) reception and transmission of orders in financial instruments;. An asset management company (AMC) is an asset management / investment management company/firm that invests the pooled funds of retail investors in. Definition: Asset Management refers to the division of a financial institution or hedge fund that manages investments on behalf of clients, from planning an. The asset manager oversees all facets of the management, financial, procedures, and resources of a property to ensure the business plan is being executed. To become an asset manager, you need a bachelor's degree in finance, accounting, or a relevant field. Experience is crucial for finding a job, so while you are. What is an Asset Management Company (AMC)? An asset management company (AMC) is a firm that invests a pooled fund of capital on behalf of its clients. The.

1 2 3 4 5